Oil is not the primary energy source in the US, coal and NG are. Oil is only the primary source of US transportation fuels, such as gasoline, jet fuel and diesel.

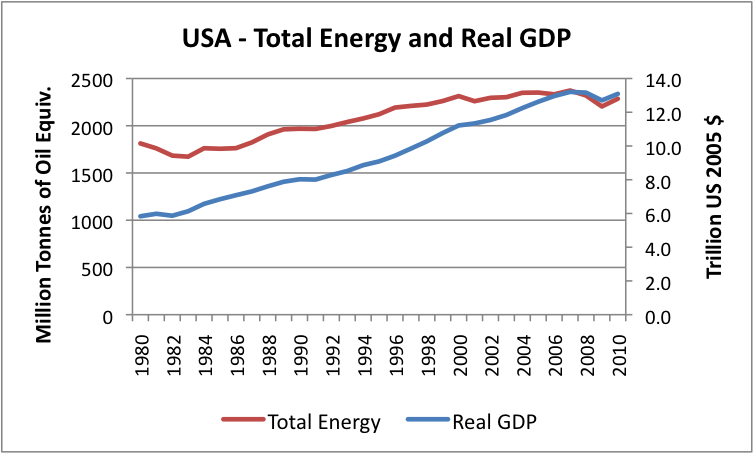

As of 2011, the US economy directly contributed 20% of global GDP, while accounting for around 18% of global energy consumption. There are indeed a few examples of countries with small economic outputs and low energy consumption that have better GDP vs energy consumption metrics, but these are really just statistical outliers. There are no large, industrialized economies (India, China, Russia, Brazil, etc.) that have better energy efficiency metrics than the US.

As for requiring major technological breakthroughs before the US begins producing large amounts of domestic shale oil/gas, this has already happened. The recent US oil/NG boom is entirely due to production of unconventional shale gas/oil resources. There is also massive amounts of heavy crude oil being economically produced from Canadian oil sands. As for the trillions of barrels of shale oil reserves in Wyoming, Utah and Colorado, they will be economically produced when long term crude oil prices stabilize above $50-$60/bbl.

Lastly, we should also consider that the US has some of the world's most stringent emissions regulations when it comes to automobiles or powerplants.

Please stop telling people 'how it is' and go look at some data. Most US energy consumed is from oil. It's been that way for over a half century. The government spends untold sums of money to generate public data so you don't have to guess what fuel the US uses most.

Furthermore, I'm not sure why you are quoting macro economic data that has little direct relevance to US energy policy or the geopolitics of energy. I'm really happy that we generate 20% of the world's economy with 18% of the energy. Unfortunately, that isn't good enough b/c we've imported $2T of oil in the last decade. Fleet fuel efficiency declined between 1986 and 1999, and we only just eclipsed 1986 fuel economy in 2010. In 1993 (IIRC), we began importing more than we produced. Between 1984-2008 our economy made almost no efficiency gains, and we twice managed to spark a recession with a minute 4% increase in per capita oil consumption (25bbl-->26bbl).

I'm not interested in the cultural BS. Honestly, I don't care if we continue burning oil, nor do I endorse starting WWIII over carbon-emissions compliance. However, I'm keen to see the US regain all of the ground it lost over the last 15 years, when our aimless energy bureaucracy steered the ship aground. The rest of the world is predicated on a strong dollar so they haven't been particularly enthusiastic about US policy either.

We consume 18.5M bbl/day, and without fuel economy regs, we'd consume closer to 21M bbl/day when the economy recovers. That's 300% of our current production figures. Even if we could be energy independent at 21M bbl/day, and we assume unrealistic recoverable reserves of 200B bbl (8x higher than USGS official numbers), we'd exhaust our oil supplies in 25 years.

Anyway, I'm not sure why I'm trying to convince you. Congress have already acted, and we are drilling/fracking everything in sight, and we've enacted CAFE 2025. First signs of intelligent life in 30 years. If we move trucks, ships, and trains to LNG and CNG, we'll be even better off.

Edited by phoenix101, 03 February 2013 - 09:45.